Aipom Ai supports traders at every experience level with artificial intelligence that structures information into practical guidance while continuously assessing market context. The design reduces repetitive manual checking and keeps decision making flexible, organised, and responsive to shifting conditions.

Aipom Ai applies refined machine learning to scan large data streams in moments, spot patterns, and surface timely market shifts. Real time visibility helps users recognise opportunities and act with greater clarity. Continuous 24/7 monitoring, a user friendly layout, and high security standards aim to keep information accessible, organised, and protected.

Aipom Ai's copy trading capability lets users explore approaches used by skilled traders. AI powered analytics sharpen judgment by highlighting current market setups. By combining advanced insights with structured views, Aipom Ai helps users develop a more methodical approach to cryptocurrency investing.

At its core, Aipom Ai applies artificial intelligence to watch global conditions continuously, spotting shifts as they develop. Machine learning translates live and historical feeds into adaptable guidance, while multi layer security safeguards account data for a steady, informed experience.

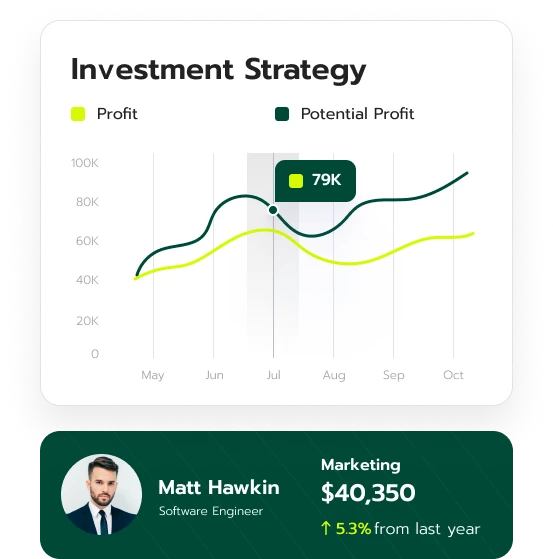

Aipom Ai’s adaptive engines flag meaningful changes early and turn them into clear, decision ready context. Patterns, momentum cues, and evolving signals are mapped from large data sets so users can assess conditions at a glance. The platform highlights critical inflection points and presents the information in a structured, actionable view.

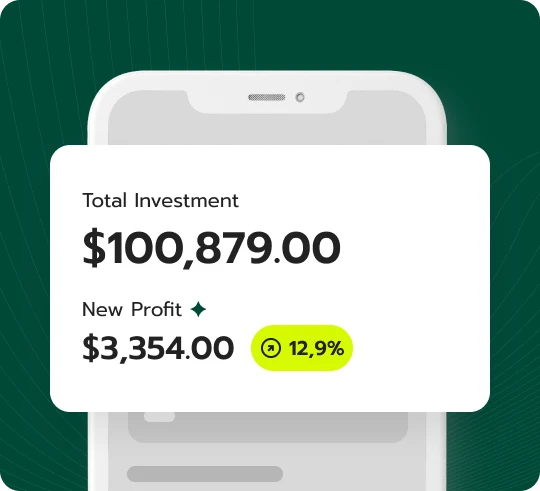

Decision making improves when significant shifts in market behaviour are surfaced and the numbers are arranged into clear, ready to use views.

Aipom Ai provides access to coach crafted trading playbooks. Instead of automatic execution, users can study proven tactics and apply them manually according to preference, while AI analytics observe longer term behaviour to balance expert thinking with data driven judgement for traders at every level.

By reviewing shared strategies and testing them against real time analysis, individuals can refine techniques without pressure. Whether assessing patterns, adjusting timing, or tracking momentum, the tools inside Aipom Ai help turn guidance into adaptable routines that grow with each user’s experience.

Aipom Ai safeguards personal information through transparent handling and responsible data practices. No transactions occur on the platform. The platform is not connected to any crypto exchange and does not execute trades; it delivers real time AI insights to inform decisions.

Aipom Ai operates as a technology led workspace where artificial intelligence supports, rather than replaces, human judgement. Tools help interpret market shifts, compare strategy options, and study asset behaviour so users can act with structure and context.

Round the clock analysis keeps attention on shifting conditions and emerging signals. Aipom Ai watches the crypto landscape and posts real time alerts when noteworthy movement appears, helping users plan strategies and align thinking with current momentum.

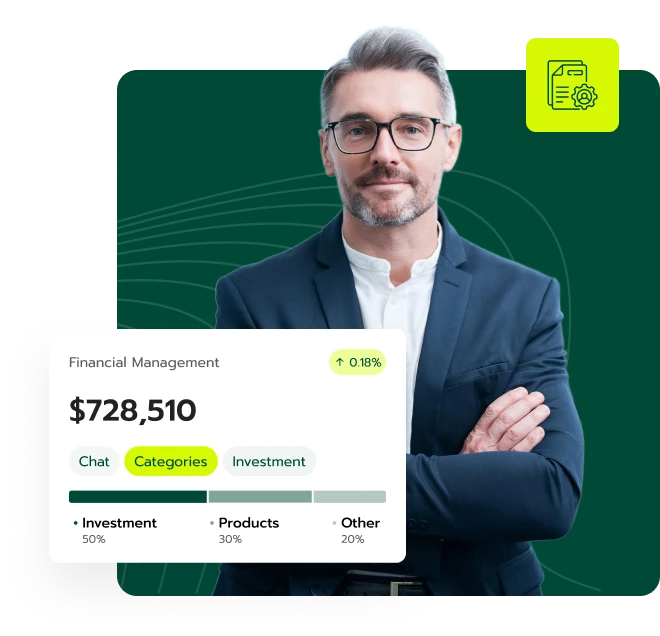

Aipom Ai arranges complex feeds into structured views that reduce noise and curb emotional decisions. Systems parse large data sets at speed to surface patterns and opportunity zones. Aipom Ai operates as an intelligence layer for reading signals across fast moving digital asset markets.

Built to evolve with the tape, Aipom Ai relies on continuous learning that adapts in real time. Static indicators are avoided; models refresh conclusions as fresh behaviour forms. Through adaptive modelling, Aipom Ai supports quicker, better informed reactions as conditions change.

Aipom Ai applies online learning techniques that respond to market behaviour as it develops. Fixed templates give way to dynamic updates as context shifts.

By refining interpretations continuously, Aipom Ai helps users act with confidence even when trading environments are unpredictable.

Aipom Ai runs a responsive engine that evaluates price action with close attention to timing, producing insights when they matter. The framework improves analytical flow, reduces uncertainty, and delivers timely, organised snapshots of conditions.

Aipom Ai features compare historical records with live inputs to keep readings aligned with current price movement. This ongoing learning approach helps strategies stay in step with the wider cryptocurrency ecosystem.

Machine Learning That Adapts to Live Market Change

Aipom Ai studies historical records alongside live inputs and updates its models continuously. This approach keeps interpretations aligned with price movement so strategies remain in step with the wider crypto environment.

History Aware Adjustments

The system retains context from prior market structure shifts and folds those lessons into its next set of projections. Blending stored experience with fresh analysis supports clear judgement during turbulent phases of digital trading.

Real Time Response to Market Triggers

When abrupt events move the tape, Aipom Ai recalibrates its readings and refreshes guidance in the moment. This responsiveness helps users review risk and adjust plans without delay, offering decision support that adapts as conditions change.

Short bursts of volatility can distract from bigger objectives. Aipom Ai filters transitory noise and keeps attention on data led reasoning, so actions feel measured and grounded in ongoing AI evaluation.

To keep operations smooth, Aipom Ai provides targeted assistance that resolves technical issues quickly. Clear tutorials and expert walkthroughs help users of every level navigate complex features with confidence.

An advanced intelligence layer evaluates live market conditions and distils fast moving data into practical signals. Inside Aipom Ai, pattern recognition highlights momentum shifts, timing windows, and positioning cues so traders can align entries and exits with clearer context.

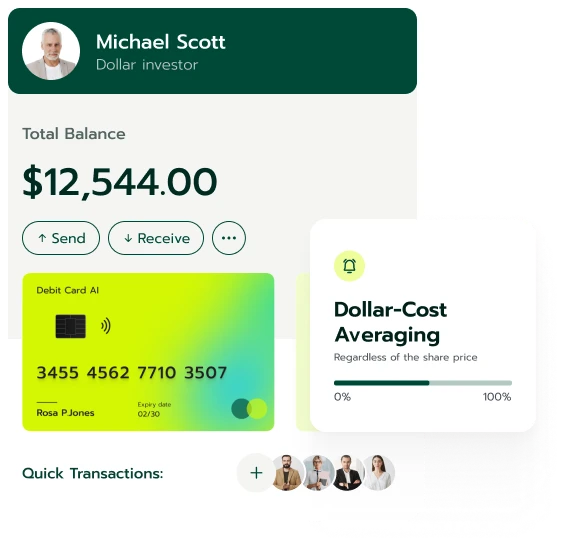

Instead of constant manual watching, the platform surfaces urgent changes and developing setups in real time. A dedicated AI analysis bot, machine learning models, and 24/7 monitoring reveal opportunities as they appear. A copy trading feature allows strategy replication from publicly shared playbooks, while the interface keeps navigation simple and fast.

Security sits at the core, and Aipom Ai applies multi layer encryption and rigorous authentication to safeguard information. The platform is not connected to any crypto exchange and does not execute trades; it delivers real time, AI driven insights to guide decision making. With structured resources for beginners and active traders alike, Aipom Ai helps users build consistent habits without automated order flow.

A disciplined process keeps analysis steady across varied market moods. Aipom Ai supports a spectrum of trading styles,from short term momentum to longer planning, so users can calibrate playbooks to risk tolerance, market behaviour, and personal objectives. By reviewing price history, liquidity conditions, and current trend strength, the platform encourages repeatable methods that adapt to broader cycles.

Round the clock analytics convert raw feeds into concise alerts, dashboards present the key context first, and machine learning refines signal quality over time. Real time insights, a user friendly layout, and consistent terminology reduce friction so attention stays on execution planning and risk control.

The AI layer inside Aipom Ai compares rapid rotation tactics with hold and ride frameworks, outlining how each style fits different risk appetites and schedules. Fast approaches lean on quick price inflections; longer horizons emphasise trend endurance and position sizing. Clear comparisons help users align method and timeframe without copying language from the original source.

Markets move cleaner when depth is strong and spreads are tight; thin books can magnify slippage and erratic candles. Aipom Ai maps liquidity pockets and monitors flow so users can spot stable regions for staging entries or scaling out. The goal is to connect timing with tradable conditions, not to place orders.

Predefined tolerances, target zones, and invalidation points keep plans consistent. Using AI context, Aipom Ai highlights areas where risk compresses and reward expands, helping users set levels before momentum builds. These references invite periodic reviews rather than reactive changes mid trade.

Large data streams require disciplined filtering. Real time processing, machine learning refinement, and 24/7 monitoring turn noise into succinct prompts that support preparation. The platform is not linked to any exchange and does not execute trades; Aipom Ai provides insight so users can manage decisions independently.

Toolkits span momentum, trend, and retracement views. Aipom Ai presents signals inspired by well known concepts such as momentum oscillators, divergence checks, and Fibonacci style zones, alongside copy trading options for observing and replicating public strategies. Interfaces remain simple so attention stays on plan quality and risk. Cryptocurrency markets are highly volatile and losses may occur.

Retracement ratios outline probable pullback zones derived from prior swings, useful for planning where reactions often begin. A stochastic style oscillator highlights stretched conditions, while a MACD style gauge follows momentum and trend alignment to signal potential turns within larger cycles.

Crowd mood is shaped by news flow, social chatter, and trading behaviour. Aipom Ai organises these inputs into a clean snapshot so users can judge whether conditions lean toward confidence or caution.

Sentiment helps frame whether conditions tilt toward optimism or caution, which can hint at upcoming swings. Bullish tone often aligns with rising momentum; bearish tone can precede softening prices. Using this backdrop to plan reduces guesswork and supports more deliberate strategy building.

Blending crowd mood with technical signals gives a broader picture of direction. Aipom Ai applies AI tracking to detect turns in dominant viewpoints so users can stay aligned with major trends and act with stronger context.

Employment data, inflation moves, and policy shifts frequently ripple through digital assets. Aipom Ai converts these influences into concise AI driven cues, helping users see how changing backdrops may affect valuations without naming outside companies or platforms.

Timing matters. Aipom Ai evaluates historical behaviour alongside live conditions to surface windows when momentum or volatility may expand. The system reads price dynamics and related signals so research, preparation, and plan execution can be scheduled more deliberately.

Diversifying exposure can reduce the impact of sharp moves and help smooth portfolio paths over time. Aipom Ai reviews historical profiles across asset types and delivers AI based assessments that clarify how different mixes may fit current market behaviour.

Aipom Ai filters noise and surfaces quickly forming price structures. The system spots tiny dislocations and short bursts of activity, returning rapid context so small fluctuations can inform short term tweaks or pattern recognition.

Trend shifts often whisper first. Through momentum centred analytics, Aipom Ai highlights early structure changes and emerging drive. Findings are organised into concise, practical notes that signal when market energy starts to gather pace.

Aipom Ai performs AI driven volatility reviews to decode sudden behaviour. Shifts are framed with clear context so turbulence becomes easier to interpret and plan around, improving situational awareness during unpredictable phases.

Volatility moves fast,and so does Aipom Ai. Continuous monitoring flags sharp spikes or dips as they appear, tempering emotional reactions and supporting steady, methodical choices. The platform is independent of exchanges and does not execute trades; it provides real time AI insights for guidance.

Aipom Ai pairs advanced algorithms with expert led interpretation. Large data streams are scanned for patterns and emerging opportunities, then distilled into structured, research ready outputs so decisions can be framed with both technical depth and human context.

| 🤖 Initial Cost | Registration is without cost |

| 💰 Fee Policy | Zero fees applied |

| 📋 How to Register | Quick, no-hassle signup |

| 📊 Educational Scope | Offerings include Cryptocurrency, Forex, and Funds management |

| 🌎 Countries Serviced | Operates globally except in the USA |